A version of this blog was originally published in ImplantKnowledge, Kermit's free monthly LinkedIn newsletter. Click here to subscribe to ImplantKnowledge and get more stories like this first.

The FDA 510(k) is a pre-market approval process for medical device manufacturers that allows their devices to be approved for market by proving "substantial equivalency" to predicate devices already in the market.

Because the approvals rely on the health and safety testing results of the predicate devices, the process allows manufacturers to get their new product to market faster (typically within 90 days) and cheaper since many of the typical costly testing and trials are not required.

While the process is a major benefit for the manufacturers, questions have been raised from providers and patients, questioning costly mark-ups compared to the "significantly equivalent" devices, as well as increasing concerns over patient safety.

What Can Be Found in an FDA 510(k) Approval?

Because the FDA is a government agency, all FDA 510(k) documentation is available to the public on the FDA's website.

Through searching by the specific 510(k) number, product type, manufacturer, or device name, all documentation submitted to the FDA can be found, as well as the FDA's approval letter which clearly lists the predicate devices.

Aside from providing great insight into the FDA 510(k) approval process and its requirements, this database can also be useful for hospital supply chain teams tasked with contracting for these devices.

In a typical 510(k) filing (examples can be found later in this newsletter), you will see the response from the FDA approving or denying the application based on substantial equivalency and the filing from the manufacturer which includes the product description, a list of predicate devices that believe this new device is substantially equivalent to, the testing that was or was not performed, and the reason they believe this device has substantial equivalency.

"Marketed in Interstate Commerce Prior to May 28, 1976 ..."

Did you catch that in the criteria from the excerpt above? In order to receive FDA 510(k) approval, the submitted device must have a predicate device marketed prior to May 1976.

In 1976 ...

Jimmy Carter was elected president.

Apple was founded.

The first Rocky movie was released.

The VHS was first introduced (but had not yet made it to the U.S.).

That predicate device was being marketed.

As we stand today in 2023, we are closer to the year featured in The Jetsons (2062, 39 years away) than we are to 1976 (47 years ago).

A prevailing criticism of the FDA 510(k) approval process raises questions of whether it is outdated and hinges on decades-old standards. While most of the devices appearing in the market today have predicate devices that were introduced post-1976, a direct line can be drawn back to the pre-1976 device that all were substantially equivalent to.

The FDA 510(k) Process Has Faced Mainstream Criticism

Earlier this month on the same day, two separate research articles were published in the Journal of American Medical Association (JAMA) that raised concerns over the connection between the FDA 510(k) process and the probability of recall.

One report featured research from the University of Minnesota that reviewed 35,000 devices with 510(k) clearance between 2003 and 2018 and determined that devices with 3 or more predicates that currently have recalls are 81% more likely to be recalled.

The other report, collaborative research between Yale, Harvard, and Cal-San Francisco, analyzed 156 FDA 510(k) approved devices with Class 1 recalls from 2017 through 2021 and found that not only did 44% of those devices have predicate devices with a Class 1 recall, but 48% of the recalled devices between 2017 and 2021 were used as predicate devices for subsequent devices, further perpetuating the cycle. Overall, the research found that devices approved through the FDA 510(k) process claiming a predicate device with a Class 1 recall was 6.4 times more likely to have a Class 1 recall of its own.

This is not the first time that the FDA 510(k) process faced criticism when it came to the impacts on patient safety. In 2018, Netflix began streaming a documentary called "The Bleeding Edge" that explores the medical device industry, specifically highlighting the dangers and issues associated with certain devices, the regulatory process for medical devices, and the relationships between device manufacturers and the FDA.

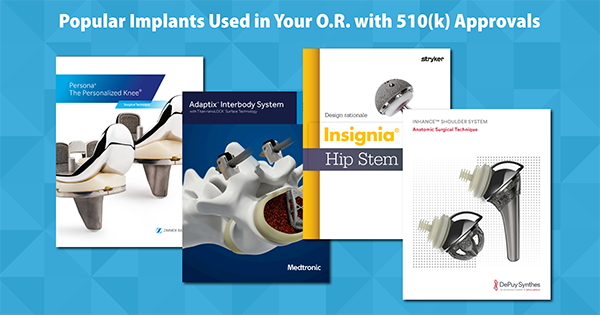

Some of the Top Implants in Your OR Have FDA 510(k) Approval

Across divisions and suppliers, it is safe to say that some of the most used implants at your hospital have FDA 510(k) approval with substantial equivalency to predicate devices. These include (with links to the 510(k) filings):

INHANCE Reverse Shoulder System from DePuy Synthes

INSIGNIA Hip Stem from Stryker

Adaptix Interbody System w/ Titan nanoLOCK Surface Technology from Medtronic

Persona Knee from Zimmer Biomet

Kermit is not evaluating, criticizing, or commenting on the clinical validity or safety of these items, but simply stating their status as approved through the FDA 510(k) process.

Substantially Equivalent or Cutting Edge?: The Dollars and Cents of FDA 510(k)

If implant manufacturers are saving money and accelerating their speed to profit by stating substantial equivalency to products already in the market, why should hospitals pay a markup under the auspice of innovation?

While hospital operating margins have been in the negative every month since January 2022, multiple leading implant manufacturers saw double-digit revenue gains, including a reported 19.2% increase by Stryker, 11.5% from Zimmer Biomet, and 10.6% from DePuy Synthes.

After a decade of managing implant spend for hospitals and health systems, Kermit estimates that hospitals are overpaying for implants by an average of 30%, and the commoditization of implantable medical devices being hidden under the price tag of innovation is a major culprit.

You would not pay a premium price for a 2023 vehicle that the manufacturer says is substantially equivalent to the one they made in 1975, or even the one that they released in 2010. Why should we treat implants any differently?